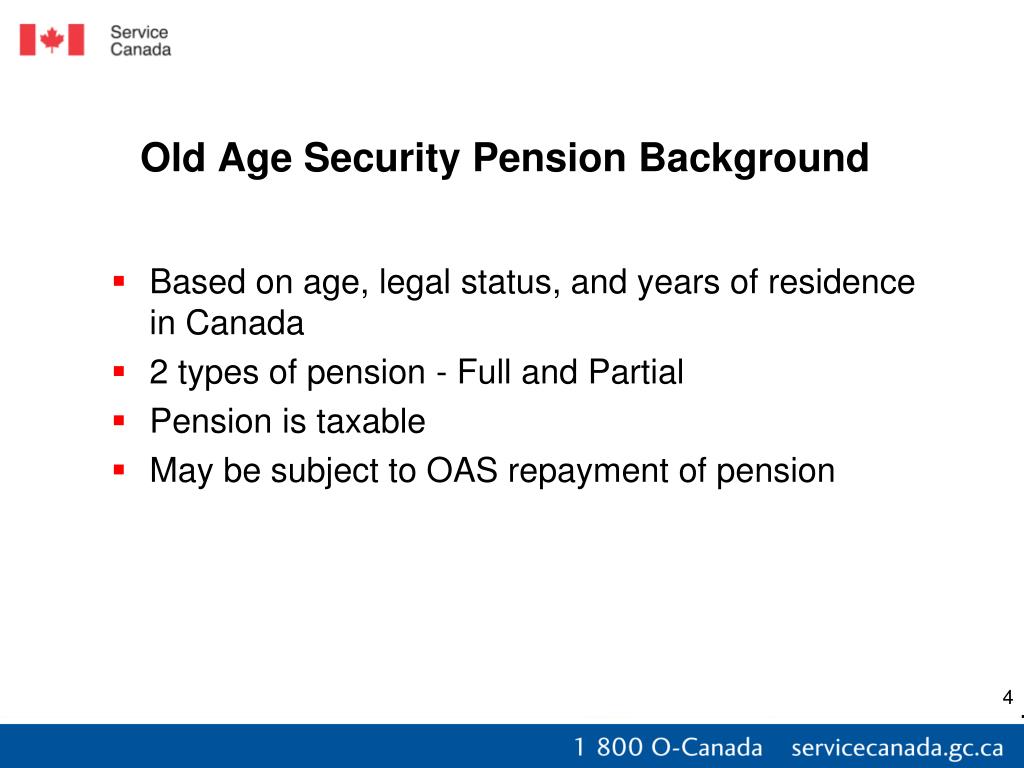

The payment amount for the Old Age Security pension is determined by how long you have lived in Canada after the age of 18. It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year. Payment

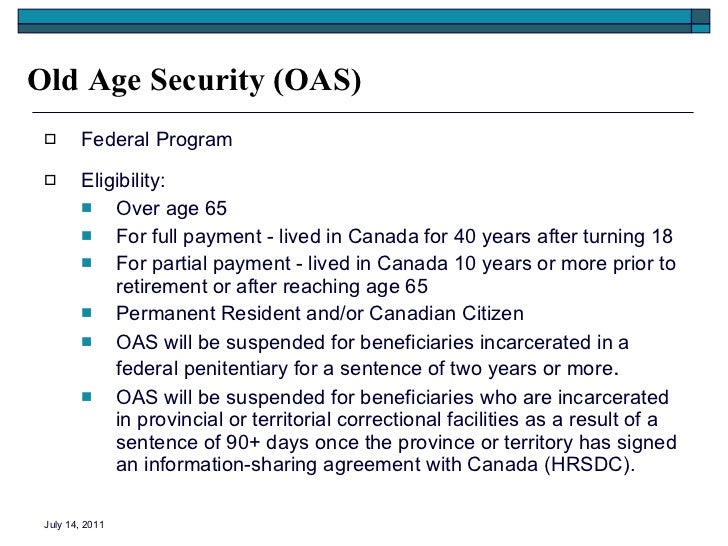

The Old Age Security (OAS) program is the cornerstone of Canada’s retirement income system. It includes a basic pension that goes to almost all people 65 or older who have lived in Canada for at least 10 years over the age of 18.

Page1of4 When to apply Social Security Agreements Qualifying for the Old Age Security pension Human Resources Development Canada Développement des

The Old Age Security pension (or OAS or OAS-GIS) is a taxable monthly social security payment available to most Canadians 65 years of age or older with individual income less than $122,843.

The Canadian government raises the eligible age for Old Age Security benefits to age 67 but gives plenty of notice.

Canada Pension Plan and Old Age Security A. CPP Overview Canada Pension Plan is a contributory, earnings-related insurance program. This means that you must have contributed to the program in order to receive

Information about eligibility and applying for an Old Age Security Pension in Canada.

GATINEAU, QC, Dec. 30, 2015- Canada Pension Plan and Old Age Security benefit amounts effective January 1, 2016.